We know that you may have many questions regarding how to save money on estate taxes. In our last blog, we discussed the basics of how the discounting of assets work. Now, our estate planning attorneys will walk you through more on how to make it happen.

How to Use Discounting

Some assets are great for discounting, while others are okay for discounting. And one type, in particular, is bad for discounting. The essence of discounting is the subjectivity in the valuation of an asset. For instance, there can be a lot of subjectivity from what one person thinks versus what another thinks is the value of a minority interest in a closely held business. There is essentially no subjectivity in the value of an amount of money sitting in a bank account.

The more subjectivity in the valuation of an asset, the more discount the asset receives. Assuming the asset is held in a way that a discount can be applied, the following is a list of some types of assets and the discount percentage you might expect to be applied to their value.

- Closely held business interest: High Discount – Range of 35%-45%

- Real property (excluding personal residence): Medium Discount – Range of 25%-35%

- Marketable investment: Low Discount Range of 10%-15%

- Cash and bank account: Essentially No Discount

Now, we need to create a situation for these assets to receive a discount. In our last blog, we discussed the idea of a business that has (1) both voting and non-voting ownership interests (we will generically call these interests “shares”, like with stock, even though they technically might not be considered stock), and (2) a restriction on the transfer of the non-voting shares. Here is how we make this happen.

Existing Closely Held Business Interests

Assume the client has an existing business, like an LLC. In almost every case, all of the shares in the LLC will be voting shares. Why is that? Because when it was set up, no one thought about any reason to have any shares other than voting shares. At MHPS, when we set up businesses for our clients, we usually do voting and non-voting shares from the start in anticipation of the need for future planning.

If a business has only voting shares, it is not a problem to convert all of the voting interests into a combination of both voting and non-voting shares. For instance, if the business has a total of 100 shares that are all voting shares, we might convert them into 2 voting shares and 98 non-voting shares. There are still 100 total ownership interests. They are now divided between voting and non-voting.

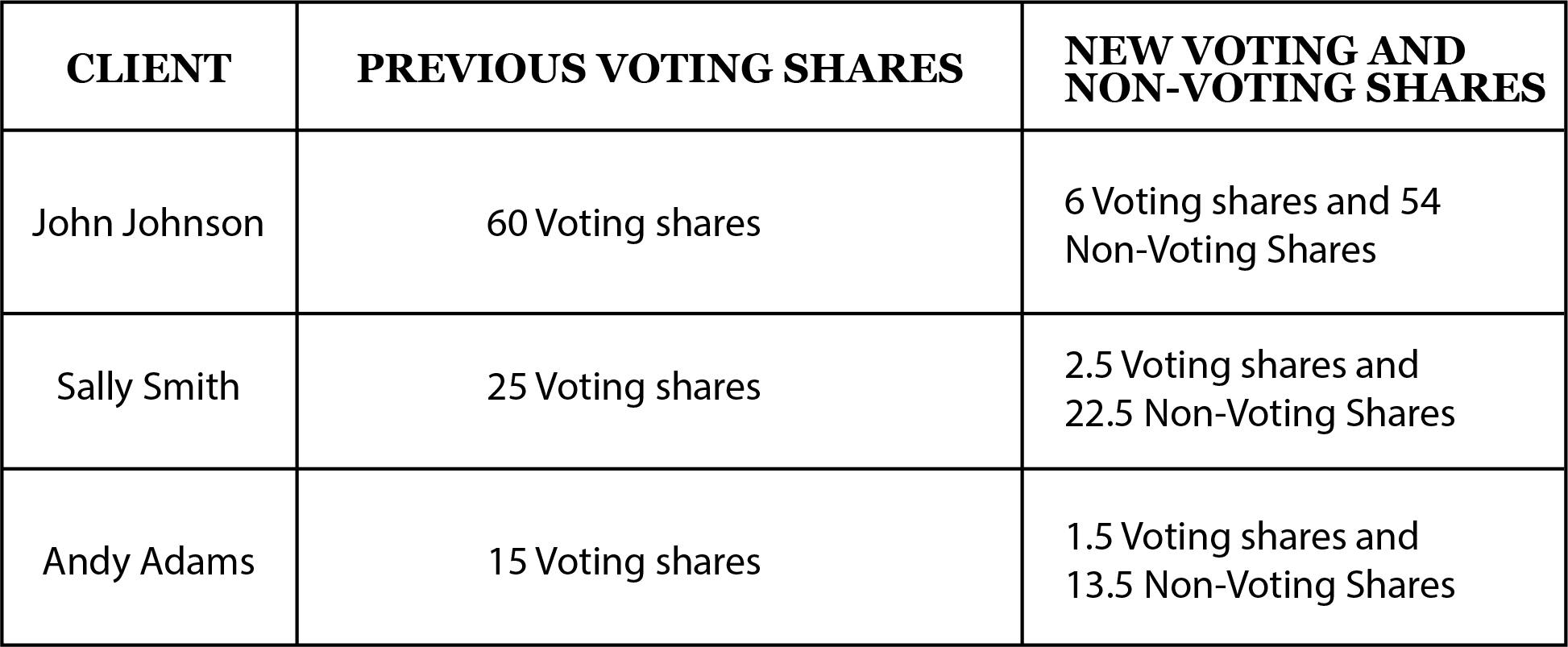

We recapitalize the company to convert the voting shares into a combination of voting and non-voting shares. This sounds more complex than it is. It is nothing more than an agreement executed by all the owners stating that they agree to convert the voting shares into voting shares and non-voting shares. The agreement will detail the amount of his/her previous shares and his/her new shares for each owner. It could look something like this:

You will notice that after the recapitalization, all three owners retain the same voting authority as before. Both before and after the recapitalization, John has 60% of the voting authority, Sally has 25% of the voting authority, and Andy has 15% of the voting authority. No one has lost or gained any authority in the business.

The next step is for the owners to execute an agreement putting a restriction on the transfer of the non-voting shares. This agreement states that no transfer of non-voting shares can occur unless the transfer first receives consent to transfer from a majority of the voting shares.

Real Estate and Other Assets

If a closely held business does not already exist, we can create one. In most situations, we create an LLC (referred to as a “Family LLC”) having both voting and non-voting shares. After the Family LLC is created, the assets are transferred into the LLC. Real property is transferred by way of a quitclaim deed. The LLC can set up an investment account and the personal investments can be transferred into the new LLC account. This transfer of investments into the LLC will be done “in kind” and will not be considered a sale. Thus, the transfer will not generate any capital gain.

As part of the creation of the Family LLC, the owners will execute the agreement restricting the transfer of non-voting shares described above.

The result of all this is that the assets are held by an entity structured to receive a discount.

Learn More About Estate Taxes

In our next blog, we will discuss another strategy to save estate taxes – an Estate Freeze. Of the two strategies, the Estate Freeze is more powerful than Discounting. But, what is actually the most powerful strategy is to combine an Estate Freeze with Discounting, which we will also cover.

Contact our estate planning attorneys today if you have questions regarding estate taxes.