At MHPS, we’ve been discussing the various strategies that can help clients save on their estate taxes. This is the second of a two-part blog series covering the estate tax saving strategy of an estate “Freeze.” In our last blog post, we covered how Freezing works. In this edition, we will apply some numbers to show the power of an Estate Freeze. Again, Discounting and Estate Freezing are not for everyone – they are only needed for clients who already have, or are concerned about having a taxable estate in the future.

Examples of Estate Freezes

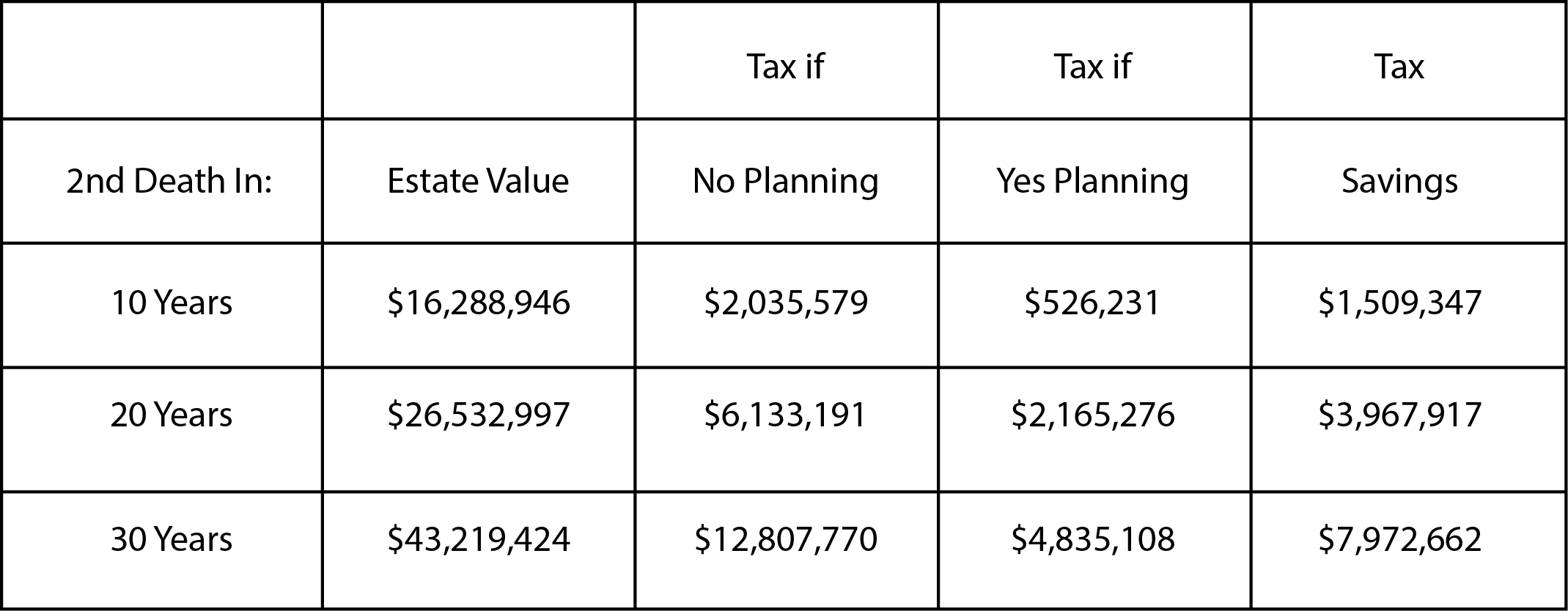

There are two schedules with this edition that show the power of a Freeze. The schedules show the growth of the client’s assets over time with different appreciation rates. The first schedule shows what estate taxes would be owed by the client’s estate over time if no Freeze is done. The second shows the possible estate tax savings over the same time if a Freeze is done.

To create an analysis, we need to make some assumptions:

- Client is a married couple.

- Ages 65 and 62.

- The total estate is valued at $10,000,000. Of the $10,000,000, $6,000,000 will be frozen.

- The estate tax rate is 40%.

- The estate tax exemption is $5,600,000 per person. This is the amount that reflects the upcoming already-in-the-law reduction of the exemption amount in 2026 (the “sunset provision”) to $5,600,000 per person, and twice that for a married couple to $11,200,000.

Currently, a married couple can pass about $23,000,000 estate tax-free. For a married couple, the existing law reduces that amount by more than half to $11,200,000. That is a loss of $11,800,000 in estate tax-free assets because the calendar flipped from December 31, 2025, to January 1, 2026. At a 40% estate tax rate, that comes out to the family losing $4,720,000 to the IRS.

The analysis shows:

- Three different growth rates for the assets – 3%, 5%, and 7%.

- Estate tax is due when the last of the couple dies.

- Each schedule shows 3 different time frames with regard to when the second of the couple dies. The three-time frames are, the survivor of the couple dies (i) 10 years from now, (ii) 20 years from now, and finally, (iii) 30 years from now. Obviously, the longer the couple lives, the more the assets will grow and the more estate tax will be owed.

- Please note that while these numbers look like they get extremely big, it is just math and the power of compounding.

An example from the schedules show at the 5% growth level:

How Does the Freeze Save Estate Tax?

$6,000,000 of the $10,000,000 estate is frozen for tax calculations. All the growth on the $6,000,000 over time passes without any estate tax. For instance, $6,000,000 growing at 5% for 10 years is $9,773,367. If $6,000,000 of that is frozen for estate tax calculations (which is included in the estate tax calculation) and the additional amount of $3,773,367 passes estate tax free, that saves the family $1,509,347. If $6,000,000 grows at 5% for 20 years, then the excess amount is $9,919,786, saving the family $3,967,914.

Lastly, you might ask why there is a sunset provision for the estate exemption amount set for 2026. That is a good question. It is because of a procedural rule used in Congress referred to as the Byrd Rule.

Learn More About Saving on Estate Taxes

If you have a large estate you’re concerned about, MHPS is here to help. Contact our Nashville estate planning lawyers today to see how we can help.