In our previous blog post, we discussed how one person’s Will will interact with another person’s Will. This is the second part of a two-part blog series about how one person’s Will might impact another person’s Will. Now that we’ve looked at one possible scenario, we will take the time to look at another way two people’s Wills interact.

Example of How Wills Interact

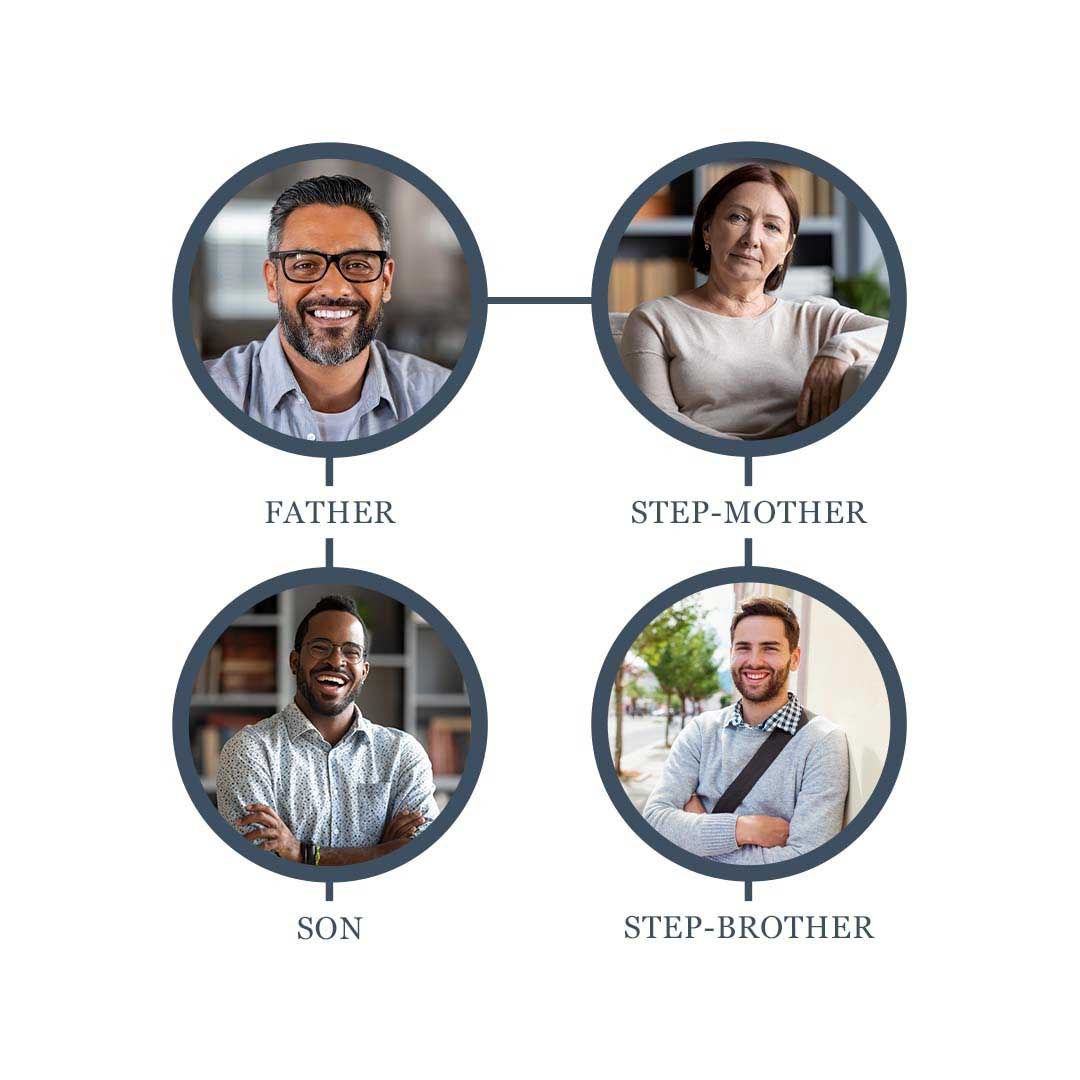

First, a diagram to depict the family:

Father, Son, Step-Mother, Step-Brother. This scenario is from the Son’s perspective. All four are living. Father has one child – Son. Father’s wife, Step-Mother, also has one child – Step Brother.

- Father’s Will says that everything goes to his wife, Step-Mother, but if she predeceases him, everything goes to Son.

- Father’s Will does not mention Step-Brother (being Father’s Step-Son).

- Step-Mother has a similar arrangement in her Will with everything first going to Father, but if Father predeceases Step-Mother, then everything to Step-Brother.

- Son is not mentioned in Step-Mother’s Will.

Father dies first. Later Step-Mother dies. Son asks if he is to receive the assets Father passed to Step-Mother at his earlier death, as Father’s Will identifies Son to receive these assets at Step-Mother’s death.

There are two possible outcomes:

- 1. If Father’s Will retains control over his assets after Step-Mother’s death, these assets pass to Son.

- 2. If Father’s Will does not control his assets, Step-Brother receives all of Father’s assets, even though he is not mentioned in Father’s Will.

Just like in last week’s situation, the answer is “NO.” Father’s Will has no authority over how the assets pass at Step-Mother’s later death. Father’s Will and Step-Mother’s Will each stand upon its own, without having either Will interact with the other’s Will.

Result of This Scenario

Similar to the result of last week’s scenario, each of Father’s Will and Step-Mother’s Will stands on their own. When Step-Mother survived Father, at his death, Father’s Will gave all of his assets to Step-Mother. From this point on, Father’s Will is ineffective for anything that happens later at Step-Mother’s death. At Step-Mother’s death, the assets she received from Father are now part of her estate and are governed by her Will. Father’s Will is now meaningless from this point forward.

Father’s Will instructs to give Son his assets “if” Step-Mother predeceases Father. But Step-Mother didn’t predecease Father. Therefore, all of Father’s assets pass to Step-Mother, and her Will controls where they go at her death.

Variation 1

But, what if at the time of Father’s death, Step-Mother’s Will included both Son and Step-Brother as her beneficiaries, not just Step-Brother? BUT AFTER Father’s death, Step-Mother revised her Will to remove Son. Unless Son could prove an actual contractual agreement between Father and Step-Mother to always include Son in Step-Mother’s Will (which is very, very difficult to prove), it will be extremely difficult to overturn Step-Mother’s revised Will leaving everything to Step-Brother and disinheriting Son after Father’s death.

Variation 2

But, what if Father wants Son to have his assets after Step-Mother dies later? Is it possible for Father to set up his estate in a way that Father’s assets pass for Step-Mother, and then at her later death, the remaining assets pass to Son? Or does Son just have to leave it to chance that for him to inherit from Father, Father needs to outlive Step-Mother?

The answer to this Variation 2 problem is for Father to use a trust. Father’s Will could create a trust for Step-Mother to hold her inherited assets, rather than simply give them to her outright. The trust could be designed to provide Step-Mother access to Father’s assets. But the trust prevents the assets from being included in Step-Mother’s estate. As such, Step-Mother’s Will has no control over Father’s assets held in the trust at her death. The trust created for Step Mother can instruct that Father’s assets pass to Son at Step-Mother’s later death, regardless of what Step-Mother’s Will directs.

Nashville Estate Planning Lawyers Who Can Help

Estate planning can be complicated, but if you want to ensure your loved ones receive the right assets after you pass, you need to take the time to do it correctly. Whether you only need a Will or a Will and a trust to ensure your assets are distributed properly, you need a Nashville estate planning lawyer to help. At MHPS, we can help with all of your estate planning needs.

Contact us to start the estate planning process.